Managing money shouldn’t feel like a mystery or a math exam. Yet, for many, budgeting feels overwhelming, where to begin, how much to save, and how to spend wisely?

That’s where the 50/30/20 rule comes in. It’s a tried-and-tested budgeting framework that’s both simple and effective. Whether you’re just starting your career, raising a family, or rebuilding your finances, this rule offers a clear structure to take control of your money without overcomplicating things.

In this article, we’ll break down how the 50/30/20 rule works, why it matters, and how to make it work for your real life.

What is the 50/30/20 Rule?

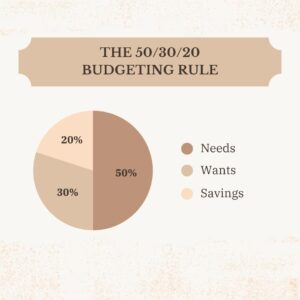

The 50/30/20 budgeting rule divides your after-tax income into three broad categories:

-

50% for Needs

-

30% for Wants

-

20% for Savings & Debt Repayment

This rule was popularized by U.S. Senator Elizabeth Warren in her book “All Your Worth: The Ultimate Lifetime Money Plan”. But its relevance goes far beyond borders, it’s a budgeting method that works universally.

Step-by-Step Breakdown of the 50/30/20 Rule

✅ 50% – Needs: The Essentials You Can’t Live Without

These are non-negotiable, basic living expenses:

-

Rent or home loan EMIs

-

Utility bills (electricity, water, gas)

-

Groceries

-

Basic clothing

-

Transportation (fuel, public transport)

-

School fees or healthcare costs

💡 Tip: If your “needs” are taking more than 50%, it’s a sign that your lifestyle may be overstretched.

🎉 30% – Wants: The Lifestyle You Desire

This bucket includes anything that isn’t essential but improves your lifestyle:

-

Dining out

-

Weekend getaways

-

OTT subscriptions

-

Premium gadgets

-

Designer clothes

-

Gym memberships

💡 Tip: Wants aren’t “bad”—but keeping them within 30% helps you enjoy life and stay financially responsible.

💰 20% – Savings & Debt Repayment

This is where your future begins:

-

Building an emergency fund

-

SIPs in mutual funds or recurring deposits. You can check out our recent articles on finance section, on Mutual funds and how even small investment can grow overtime.

-

Paying off credit card debt or loans

-

Retirement savings (PPF, NPS, EPF, etc.)

-

Investments in gold, stocks, or ELSS

💡 Tip: Automate savings on your salary day. Make it a fixed part of your financial habit – not an afterthought.

Why the 50/30/20 Rule Works So Well

-

Simple and Visual: It gives you a big-picture view of where your money should go.

-

Flexible: You can tweak the ratios based on your lifestyle or income level.

-

Balanced: It encourages both present enjoyment and future security.

-

Disciplined: Helps control impulse spending and keeps lifestyle inflation in check.

Common Mistakes to Avoid While Using the 50/30/20 Rule

-

Misclassifying expenses: OTT subscription is a “want,” not a “need.”

-

Ignoring irregular income: For freelancers or business owners, use average monthly income.

-

Not reviewing it monthly: Lifestyle and income change, so should your budget.

-

Over-saving in one category: Saving 40% is great, but not if it means underpaying debts or sacrificing essentials.

How to Start Using the 50/30/20 Rule Today

-

Calculate your net monthly income (after tax and PF deductions).

-

Apply the 50/30/20 formula.

-

₹60,000 income = ₹30,000 for needs, ₹18,000 for wants, ₹12,000 for savings/debt.

-

-

Track your expenses using free apps or Excel.

-

Adjust and repeat monthly.

-

Review goals quarterly. Are you hitting your targets or overshooting?

Variations of the 50/30/20 Rule (Advanced Users)

Not one-size-fits-all? Try these:

-

70/20/10: For aggressive savers.

-

60/30/10: If you’re paying off high-interest debt.

-

40/30/30: For early retirement planning.

👉 Your lifestyle stage (single, married, kids, retired) may influence the ratios, and that’s okay.

Final Thoughts

The 50/30/20 rule isn’t magic, it’s mindset. It brings order to chaos, balance to overspending, and purpose to every rupee you earn. Whether you earn ₹20,000 or ₹2 lakh a month, this simple structure can help you build a stable, stress-free financial life.

So start small. Be consistent. Review regularly. And let your money work for your goals, not against them.

FAQs

1. What is the 50/30/20 rule?

It’s a budgeting plan that allocates 50% of income to needs, 30% to wants, and 20% to savings or debt.

2. Who should use the 50/30/20 budgeting rule?

Anyone looking for a simple way to manage money, especially young earners and middle-class families.

3. Does this rule work for low-income earners?

Yes, but you may need to adjust the ratios (e.g., 60/20/20) based on your situation.

4. What if my “needs” exceed 50%?

It’s a signal to reassess your lifestyle, maybe your rent or EMIs are too high.

5. Should I include loan EMIs in “needs” or “savings”?

Basic EMIs for home or car = “needs.” Extra payments or debt clearance = “savings.”

6. Can I change the ratio to suit my income?

Absolutely. The rule is a guideline, not a commandment.

7. How often should I review my budget?

Every month for expenses and quarterly for goals or major changes.

8. Is 20% savings enough for future goals?

It’s a solid start. As income grows, aim to increase it to 25–30%.

9. What if I can’t save 20% right now?

Start with what you can even 5–10% and increase as your income grows.

Disclaimer:

Investing in mutual funds is subject to market risks. Consult your advisor before making any investment. The financial tips shared in this article are for educational purposes only and do not constitute financial advice. Readers should assess their financial condition and risk profile before making any decisions.